Device connectivity refers to the integration of various technological devices to ensure the proper functioning of transactions in the banking or retail sector, primarily. While both fields require device connectivity, the banking sector is distinguished by having specific standards that ensure the security, interoperability, and efficiency of equipment. In retail, on the other hand, there are no strict regulations or standardizations, and more flexible solutions are used.

What is a driver?

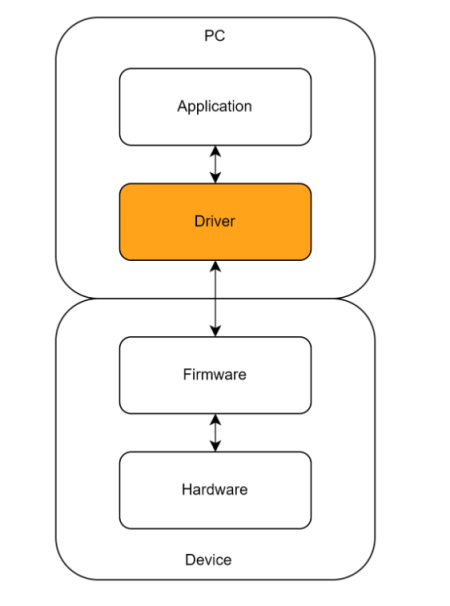

A driver is software that allows an operating system to interact with a hardware device. In the banking context, drivers are essential to connect devices like cash recyclers, receipt printers, or fingerprint readers to banking applications. These devices, through the drivers, can operate correctly within a controlled and secure environment.

As previously introduced, in the banking sector, the most commonly used connectivity standards are XFS, J/XFS, and XFS4IoT, which ensure that devices meet security, interoperability, and communication standards in branches and ATMs. Below is a brief explanation of each:

- XFS (eXtensions for Financial Services): It establishes a standard interface that banks can use to manage different brands of hardware. It is a specification that allows interaction between software and hardware in ATMs and other devices.

- J/XFS: A version of XFS adapted for Java environments, providing greater flexibility by integrating cross-platform solutions. This enables Java-based applications to interact with banking devices.

- XFS4IoT: The latest evolution, designed to adapt to modern Internet of Things (IoT) requirements, facilitates remote device connections, opening new possibilities for device automation and centralized management in the cloud.

In the image, you can see how the device connects to the operating system through the driver, which translates the banking application’s instructions into commands the device can execute, and vice versa.

What is device connectivity in banking?

Device connectivity involves the interaction between hardware and software in a bank branch. The most common devices include cash recyclers, receipt printers, fingerprint readers, among others. These devices must work together seamlessly to ensure the bank branch’s operations.

For example, when a customer deposits money into a cash recycler, the device must count, validate, and record the transaction. All this information is sent to the bank’s central system for processing. The same workflow occurs with other devices, such as receipt printers that generate transaction confirmations, or fingerprint readers that verify customer identities.

In retail, although there is a similar system for device interaction (such as payment terminals and scanners), the lack of strong standards means integration depends more on specific vendor solutions, which can create difficulties when scaling or changing systems.

On-demand APIs in other sectors

APIs have played an important role in the evolution of device connectivity. Historically, APIs were based on older programming languages like C, which offered high control but limited flexibility.

Over time, APIs have evolved into more modern models, such as REST APIs, which provide a more flexible and efficient way to connect systems and devices, allowing for greater scalability and adaptability. This evolution has been crucial for integrating services quickly and securely.

How Serquo can help you

- Serquo’s experience in connectivity: Serquo has been a reference in device connectivity for many years, working with some of the leading banks and companies in the sector. Our experience has allowed us to refine robust and customized solutions to ensure branch devices operate efficiently and securely.

- Customized solutions and training: As experts in device connectivity, we can assist you with everything from developing custom drivers to modernizing your current connectivity. If your infrastructure still uses old standards or needs to modernize with REST API architecture, we are fully capable of doing so. Additionally, we offer specialized training for your team, ensuring they can manage and maintain these systems independently.

- Dwide: Our Dwide solution facilitates real-time device management and connectivity, allowing centralized monitoring and remote control of devices in branches. With Dwide, you can ensure each device works properly, reducing downtime and improving the customer experience.

Conclusion

Device connectivity in bank branches is a crucial factor in ensuring efficient, secure, and modern service. Through standards like XFS and more modern API solutions like REST, it is possible to create environments where all devices interact without friction. At Serquo, we specialize in offering solutions tailored to current needs, helping organizations evolve and adapt to new technologies.

Would you like to modernize the connectivity of your banking infrastructure? At Serquo, we can help you achieve this. Contact us for more information!